0 Why do they lie to us about taxes?

- Economy

- by Adrian Mark Dore

- 29-11-2023

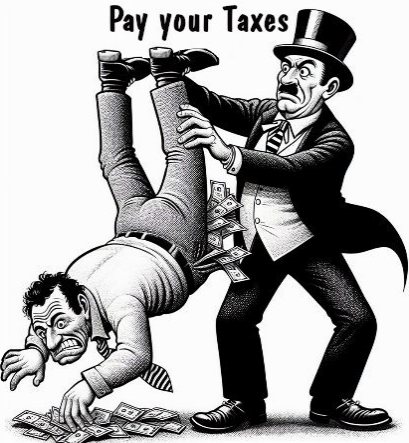

“Taxes are a burden from which you receive little or no benefit” is the popular notion promoted by the rich and their puppets, the politicians. This is nothing more than a bare-faced lie intended to promote their free market agenda of cutting taxes, particularly on the rich and corporations.

Governments collect taxes to invest them wisely for the benefit of the majority. They invest them in what we broadly refer to as Common Capital – the wealth we all share. It is used to provide infrastructure and services to all citizens and businesses.

Common Capital investment distinguishes developed from developing economies. Life is easier and better for citizens and businesses in a developed economy rather than a developing economy because of this investment.

Think how badly off you would be without roads, hospitals, schools, universities, social security, services, police, judiciary, defence, and everything else. All the things taxes fund – in other words, our Common (Shared) Capital.

As taxes fund Common Capital, we weaken society and the economy to everybody's detriment if taxes are reduced, particularly on the rich and corporations (those who benefit the most from the economy and can contribute the most).

To escape paying higher taxes, the rich proposed an alternate solution. They claimed that reducing taxes on them and corporations and minimising trading restrictions would allow them to invest more in our economy and grow government revenues. From this increased economic base, we would all benefit.

This is what they promised but have never delivered on. Consequently, Common Capital has declined significantly, and as a result, so has the quality of life of the majority plummeted as it’s directly linked to Common Capital investment. We are moving backwards and are now more representative of a developing rather than a developed economy.

The promise of the rich, through their hare-brained free market policies, has not delivered and never will. Read my article Free market policies — the broken agreement. | by Adrian Mark Dore | Medium. Consequently, we need to revert to high personal tax rates on the rich, alleviating the burden placed on the hard-pressed middle class while also pushing corporate taxes up much higher.

This will allow the government to reinvest in Common Capital and establish the correct growth base. There’s a simple principle at play here. When you have a strong society, you have a strong, resilient economic base with inbuilt stabilisers. There is a direct correlation between societal well-being and that of a strong economy, which free marketeers want to hide and mislead you about. That is why tax is not a burden because the government is making wise investments to improve the quality of life for all by investing in – infrastructure, health, education, security, social support, policing, defence – the list goes on and on.

Here’s a question for you – when it comes to taxing the rich and corporations, would you tax them now, using high tax rates with the certainty of high tax revenues, or rather wait on the vague promise of higher revenues made by people who have yet to deliver against this promise?

Of course, this is a stupid question because the answer is obvious. Who in their right mind can trust the self-serving rich and corporations to serve anybody other than themselves? People who have proved their promises are worthless.

Normally, when somebody breaks a promise, you become wary of them. You find out what they have been getting up to. To discover they are not reinvesting in our productive economy as promised but rather in the rentier economy and globalisation, which is harmful to the majority. You learn they have done so because this offers them greater returns. They are not remotely interested in acting on behalf of the majority; they are hurting them. Then, as a wise and responsible government, you repeat your mistake of trusting them year after year for over forty years. This is stupidity personified.

Tax cuts on the rich and corporations are unjustified no matter which way you look at it. Tax rates on both must be raised significantly and immediately.

Of course, the rich will squeal like fat little piglets, but that should not concern us. Our corrupted politicians (puppets of the rich) naturally tell us differently. They will tell you that corporations will relocate if we don’t offer attractive tax rates. This is true; corporations do revert to strongarm tactics (blackmail), which politicians pander to. Free market policies, in the form of globalisation, have given corporations negotiating strength (one of the many disadvantages of globalisation.)

However, corporations don’t hold the upper hand; governments do because they control access to their markets. Access to these markets is of paramount importance to corporations. If they threaten to relocate, they cannot access our markets on the same terms as if they resided here. You can’t expect access to a market if you don’t contribute to its upkeep. Hence, access must be linked to a comparable tax contribution in whatever form that takes. As business people are keen to sprout, “There’s no such thing as a free lunch”, is an idiom which aptly applies here.

The spineless politicians will respond that this is against free market trade agreements. These are the same ridiculous agreements they agreed to, which destroy our domestic manufacturing and leave us vulnerable to corporate blackmail, where they do not contribute adequately to the maintenance of our Common Capital. Politicians got us into this pickle, so now they can get us out by breaking these agreements.

To stop the downward cycle in quality of life for the majority, our spineless politicians must increase the reduction in Common Capital investment by taxing the rich and corporations heavily.

Paying tax isn’t something we welcome, but try and see it in a different light, not as an unnecessary burden but as something that protects and helps you live a fuller life. Try and see taxes as insurance and investment for you and your family because that’s precisely what they are.

You hold these negative perceptions of tax by design. The rich minority promote the idea of taxes as a burden because it’s part of their free market economic policies, which call for lower taxes. By getting the majority on their side by thinking high taxes, particularly on the rich and corporations, are wrong, they succeed in swaying government support for their flawed ideas.

Like most free market ideas, they are fundamentally wrong, hurting the majority.

When you see taxes in a different light of protecting you and helping you live a fuller life, you appreciate why cutting taxes, particularly on the rich and corporations, is seriously wrong.

You may read other articles by Adrian Dore on Medium at